A rule of thumb that most investors are taught—or learn the hard way—is to stick with what you know. This rule is why very few people readily invest their hard-earned cash into endeavors they know little to nothing about, or into complex ventures which make it difficult to understand the inherent risks of the investment.

A natural consequence of this rule is that homeowners and business owners discover an interest in real estate investing, partly due to their limited experience with their own properties. However, not all individuals have the stomach for property management and development, which leads many to transition into the industry known as “seller-carry loans,” also known as first deeds of trust (FDOT).

Many individuals are first exposed to FDOT investing when they sell a property they once owned, but choose to hold the note themselves rather than using a bank to finance the transaction. This creates an income stream that is tied to a property that is familiar to them. Investors appreciate the concept of having their FDOT investment protected by a specific property that they know well and can physically see and touch. Additionally, when the FDOT is initially written, there is a stated interest rate that is typically locked for a period of time, which can give an investor a sense of confidence that the investor yield is locked in for the life of the loan. In reality, the actual yield on the life of the loan will be dependent upon the borrower’s ability to pay and is only backstopped by the pledged collateral, in this case the property in question.

For active investors who want to originate, underwrite, service, and manage their own loan portfolio, investing in FDOTs can be a full-time job. Finding individual opportunities from reliable borrowers with good quality collateral requires either an investment of time, or the payment of fees to any number of affiliates such as brokers or other investors. However, for those investors that like to have control of the entire process, managing an FDOT portfolio can be rewarding.

It should be noted that brokers and other affiliates can present an investor with what is known as “agency risk.” Agency risk means that not all members share common goals or risk factors. For example, if a broker has the opportunity to sell a note, but bears none of the risk if the note fails to perform, this creates tension between the goals of the investor and broker. Investors should be wary of these relationships and use caution whenever an investment opportunity is presented by a broker who has “no skin in the game.”

Risk and Return – LTV Ratios Explained

Overwhelmingly, most FDOT investors prefer these investments because FDOTs are collateralized by real estate, effectively protecting their principal investment. Provided there are conservative underwriting principles along with stringent due diligence, this can indeed be a definite positive for FDOT.

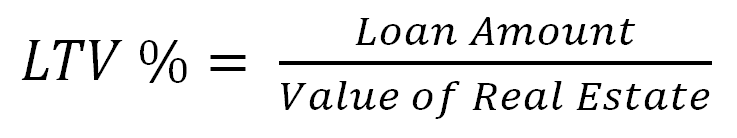

One commonly used metric to grade the riskiness of an FDOT is the Loan to Value ratio (LTV), written as:

The general rule of thumb is, the lower the LTV%, the higher the likelihood that the principal is protected. However, there are nuances to consider when applying this rule, namely the volatility of the underlying asset class or who is determining value. While FDOT opportunities collateralized by raw land may have a low LTV (typically 40% or less), these properties are undeveloped and unusable until improvements are made. As a result, land is considered to be a highly volatile asset class, and a loan with an LTV of 40% in one year could have an LTV of 65% the next year if the value of the land drops. Buildings in established neighborhoods or business parks have less volatile valuations than land, and typically have higher LTVs. For those investors seeking more conservative investments, look for LTVs 50% or below for already developed real estate in existing communities. Investors should be advised that given the degree of safety in these loans, investor yields will not be as high as those seen with higher LTV investments and more volatile asset classes.

As noted above, another key consideration is the concept of value. More specifically, how value is calculated, and who determines it. Using independent 3rd party appraisals is a requirement to ensure an unbiased estimate of value. More importantly, the appraisal should be ordered by the party that will be holding the note for the long term. If a borrower or broker orders an appraisal, they typically have an incentive to drive up the value of a property, as this generates higher commissions and loan amounts. In contrast, a lender who holds the FDOT has every incentive to keep value lower, as it reduces their risk exposure over the life of the investment.

Liquidity, Concentration, and Efficiency Risk – FDOT Investment Concerns

However, there are some definite risks that are associated with investing in individual FDOTs that every investor should be aware of. One of the most common risks associated with such investments is that owning a fractional interest in a note is not a very liquid investment. In the event an investor might need to urgently tap into their investment, an individual FDOT does not offer a reasonable degree of liquidity.

Another oft-overlooked concern is concentration risk: “having too many eggs in one basket.” For example, if an investor has their money tied up in a few FDOTs, and one of borrowers stops making payments, then a sizeable portion of the cash flow has effectively ended. Another issue is that collateral is typically tied up in just a few geographic areas. In the event of changes in the market, the collateralized assets may have some or total exposure.

Lastly, there is the matter of turnover and its effect on investor yields. For example, if an individual borrower pays their note off at the beginning of the month, the investor now has to quickly find a new borrower who needs funds. If an investor is not efficient at deploying their proceeds, it can quickly deteriorate their return. To illustrate this, if a note pays 9% to an investor, but they are unable place their money for 4 weeks, this idle time decreases their effective yield by 0.75%, effectively paying the investor 8.25% for the year.

Risk Pooling – Using Mortgage Funds to Mitigate Risk

Some of the aforementioned risks can be reduced by participating in a mortgage pool, also known as a mortgage fund. A mortgage fund is simply an investment vehicle that manages a collective group of FDOT investments on behalf of its investors. This concept of risk pooling is commonly used in a number of markets, including insurance, mortgage markets, and supply chain management. The advantage of risk pooling is that by aggregating a large number of loans into a larger fund, performance is more predictable.

From a liquidity risk perspective, a singular FDOT opportunity is not as easily marketable as an investment in a mortgage fund. In most states, individual FDOT notes are often limited to only 10 investors per individual note, which can create significant barriers to liquidity in the event an investor wants to exit the investment. Conversely, an interest in a mortgage fund can more easily be traded without the same degree of regulatory requirements as an individual FDOT. Liquidity risk is not mitigated altogether, however, as most funds may have prolonged, multi-year lock up periods.

Concentration risk is also mitigated if the fund is well-managed and no key concentrations exist, meaning that no particular loan, borrower, or asset type represents an inordinately large percentage of the fund’s investment. In the event that a note could be non-performing, the impact to the fund’s investors is minimal.

Lastly, a well-managed fund is one that is highly efficient, meaning that the fund will typically have adequate deal flow, ensuring its investors’ funds are mostly invested, producing higher yields. Retaining an appropriate amount of cash on hand is necessary to account for investor redemptions and new investment opportunities.

Evaluating Fund Managers – Identifying Managers’ Incentives

While mortgage funds can mitigate several risk factors, they can introduce other risks. Every investor should prudently screen their fund managers in order to avoid this issue. One key item that can create risk is the notion of leverage. If fund managers use leverage to amplify their returns, it can be a double-edged sword, making good years great and bad years worse.

Revisiting the notion of agency risk, investors should seek to find those fund managers that have aligned their own incentives with that of their investors. Are the fund managers invested in their fund personally? Are they compensated in ways that don’t benefit the investor? Investors should be cautious when investing in funds that are entirely comprised of outside capital where the managers have no “skin in the game” as it moves all of the portfolio risks onto the investor alone.