With commercial real estate investing, it’s not uncommon to need more than just one source of capital to get the deal done. An investor might use some of their own money, borrow from a traditional bank, get a loan from a private lender, get other individuals to invest, or get capital from a variety of other sources.

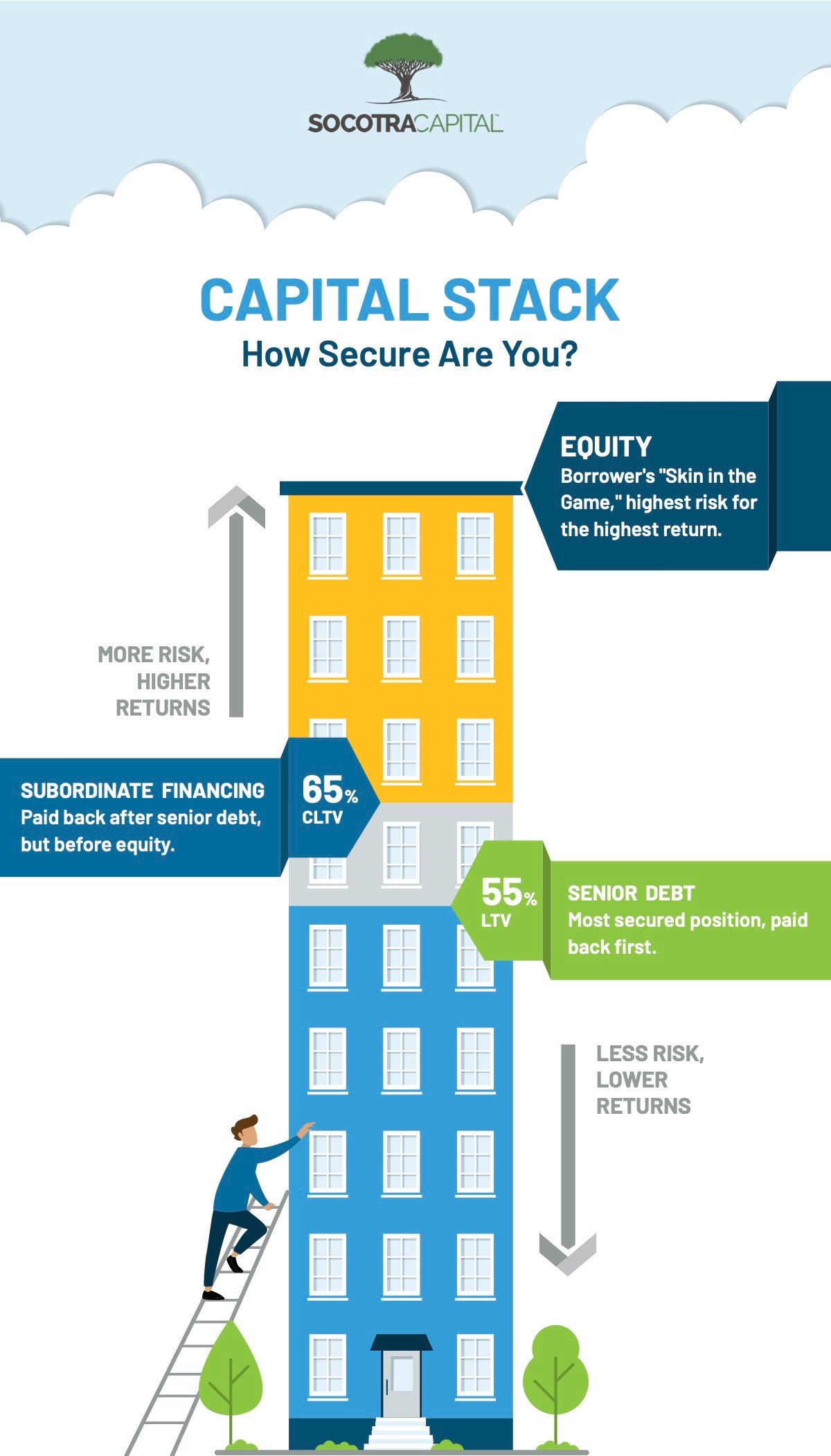

This financing structure with multiple sources of capital is referred to as the capital stack. Essentially, the capital stack tells you the order of who gets paid first in the event the property is ever sold. The structure is rarely the same from project to project, and it can get quite complex. This is why it’s critical for both real estate investors and mortgage debt investors to understand the capital stack for making informed decisions.

Elements of the Capital Stack

The capital stack consists of four types of capital sources. From highest to least amount of risk, they are common equity, preferred equity, mezzanine debt, and senior debt.

Common Equity

Equity is the borrower's cash into the deal, sometimes also called "skin in the game." Most lenders require real estate investors to have at least some equity. Equity holders assume the highest risks for the highest potential returns, and all other capital sources must be repaid before common equity holders are paid. However, having no cap on returns means common equity holders have the greatest potential for profit, but also have the highest risk since they are paid last.

Preferred Equity

Preferred equity holders get paid before common equity holders can get returns. This level is less risky than common equity, but returns can have an upper limit to the potential profit from this type of investment. Preferred equity is often used for short-term bridge financing and ranges from hard to soft equity. Hard equity has a fixed coupon and maturity date, the holder may have decision-making rights, and the rate of return is similar to mezzanine debt. Soft equity is often based on project performance and has the potential for higher returns, but holders have more limited rights.

Mezzanine Debt

Junior lien or mezzanine debt has priority over common and preferred equity. The returns are based on a fixed coupon, and debt is paid after operating expenses and senior debt has been repaid. The rates of return for mezzanine debt are typically between the common equity and senior debt rates. If the deal includes preferred equity and mezzanine debt, mezzanine debt gets repaid first.

Senior Debt

Senior debt is the loan position that is the most secured in the capital stack. It is the first to be paid back, and, therefore, has the lowest risk but also typically the lowest returns. Senior debt is secured by the property itself. If the borrower defaults, the senior lender can foreclose, take control of the property, and then sell it to recoup their investment. If a senior lender forecloses, it wipes out all other investors in the capital stack, meaning the other lenders don’t get their money back. With senior debt, the higher loan-to-value ratio typically yields the higher rate of return.

How the Capital Stack Affects Borrowers

For borrowers, the goal is to balance equity (common and preferred) and debt (mezzanine and senior) to ensure the property is sufficiently capitalized, but also to manage the risk of foreclosure. Over-leveraging—having more debt than equity—can lead to a higher risk of foreclosure if payments can’t be made. On the other hand, under-leveraging—having more equity than debt—could leave money on the table, reduce your ROI, and leave the project undercapitalized.

How the Capital Stack Affects Investors

Investors can participate in any part of the capital stack, and the appropriate role depends on their tolerance for risk, portfolio diversification goals, and desire to be hands-on with commercial real estate. Investing in senior debt offers a low-risk investment with more predictable returns when the loan is structured well.

When investing in hard money loans, it's important to underwrite not only the property but also the sponsor who is bringing you the transaction. Make sure you understand the terms, liquidity, fees, and other risk factors before making any decisions. Additionally, investing in hard money loans can be done one loan at a time or via a mortgage pool, also known as a mortgage fund. In either case, if a borrower defaults, senior debt is repaid first, which helps protect your investment. For more hands-on investors with a higher tolerance for risk, the other segments of the capital stack could be a better fit.

How Socotra Capital Fits into the Capital Stack

Socotra Capital is a private lender that invests in senior loans secured by real estate. Senior loans take priority before any subordinate debt or equity partners. This means we get paid first in the event of a sale. We keep our loan-to-values low in order to create an extra buffer of protective equity. To learn more about investing with Socotra Capital, get access to our investor portal.