This summer’s spate of devastating hurricanes impacting Texas, Florida, and Puerto Rico are a pointed reminder that everything we take for granted can be taken in an instant. It’s tempting to think of such disasters as being an ‘East Coast thing,’ and it’s certainly true that California and the rest of the Western United States are outside of hurricane territory. However, many areas are vulnerable to serious flooding just as bad as that caused by hurricanes.

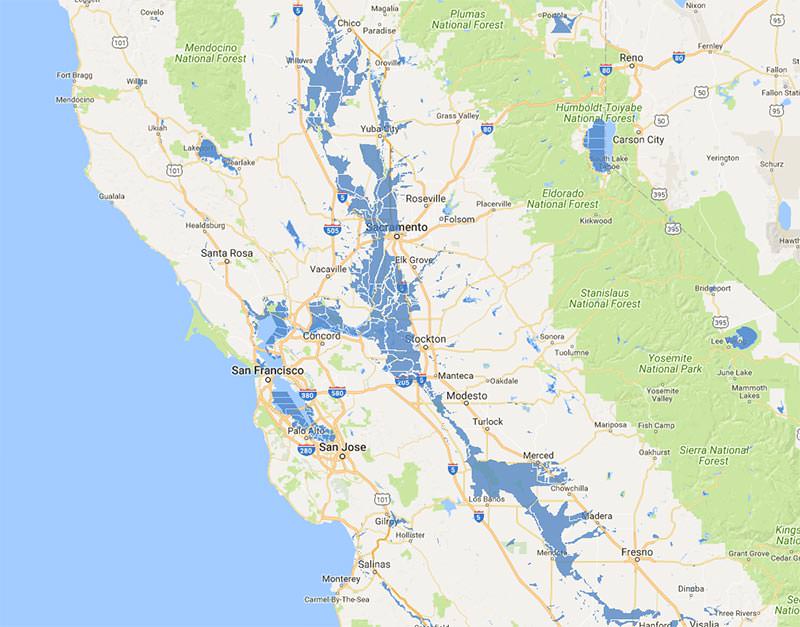

Below is a map of what FEMA has identified as 100 year floodplains in Central California (which means that those areas have at least a 1% chance of flooding in any particular year).

As many Houstonians can testify after surviving Hurricane Harvey, homes in 100, 200, and even 500 year floodplains are vulnerable to the powerful weather events that have been plaguing the country the last few years.

How can you protect your investment properties in the case of flooding?

Given the above—whether you’re a long-term investor or a fix-and-flipper—it’s important to identify whether your investment properties are at risk of flooding. The California Department of Water Resources has a powerful, easy to use site for viewing California floodplains.

Check with your insurance agent to see whether your insurance company offers insurance company. (Please note: homeowners insurance does not cover flooding!) If your insurer doesn’t offer flood insurance, you can call the National Flood Insurance Program (NFIP) at (888) 379-9531 for a list of insurance agents in your area who participate in the NFIP. The average flood insurance policy costs about $700 per year, but this varies depending on the likelihood of flooding where your home is located.

Other factors that influence the cost of flood insurance include:

- The age of your home.

- How many people live in the home.

- How large the home is, and how many floors it has.

- The elevation of the home.

- The size of your deductible.

In some cases, you may actually be required to carry flood insurance on your property. For instance, about 25% of the City of Sacramento is within the Special Flood Hazard Area (SFHA). These areas are considered to be particularly at risk of flooding, as they lie within 100 year floodplains.

Keep in mind that there are two kinds of NFIP insurance plans. The most common which covers the actual home, has a maximum payout of $250,000. The second, which covers personal property, has a max payout of $100,000. You may purchase either one of these plans, or both. If you want flood insurance on your home that covers more than $250,000—which is rather insufficient for many California homes—you’ll have to purchase an “excess flood insurance” policy. These can be difficult to obtain, so you may have to ask around to see whether any insurers in your area offer such policies.

Ultimately, if carrying flood insurance on your property is optional rather than mandatory, it’s a wise idea to sit down with an insurer and determine how vulnerable your home is to flooding, and whether a flood insurance policy is advisable.

If your home has already flooded, what do you do now?

First of all, if you have insurance, file a claim as soon as possible. If your home flooded, so did the homes of many others. You don’t want to be at the back of the line and waiting weeks or months to be compensated for your loss. Make sure to carefully document the damage, as compensation can vary depending on what may seem like minor details, such as whether water came in through the roof or the front door. Be sure to request a copy of your policy from your insurance agent if you can’t locate your personal copy.

If your home has been flooded by a major disaster and don’t have flood insurance, FEMA does offer disaster assistance through its disaster relief fund. However, FEMA payouts tend to be very small: on average, well under $10,000, with a maximum of $33,000. This assistance isn’t designed to fully compensate homeowners for their losses, but rather to help them get back on their feet. It’s not much, but every bit helps.

What if you haven’t yet purchased an investment property in a floodplain, but you’re considering it?

Property is an excellent investment choice. However, it’s possible to invest in property without actually owning it and being liable for secondary costs like flood damage. If you would like to learn more about more financially secure ways of investing in residential and commercial property, contact Socotra Capital by calling us at 855-889-7626, or sending us a message through our contact form.